net operating working capital turnover formula

The businesss net working capital ratio would be calculated like this. Even though cash is considered a current asset its not included in the operating working capital calculation because its considered a non-operating asset.

What Is The Working Capital Turnover Ratio Quora

Unlike operating working capital you do not need to remove cash securities or non-interest liabilities.

. Cash and Cash Equivalents Trade Accounts Receivable Inventories Debtors Creditors Short-Term Loans 135000 55000. I Return on Total Resources Profit after Tax Total Assets 100. Assume tax rate at 50 Dividend declared amounts to Rs120000.

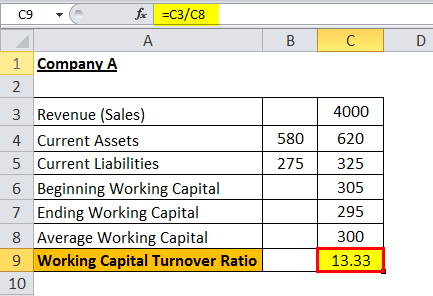

Free cash flow equals net operating profit after taxes minus change in total net operating capital over the period. Working capital turnover Net annual sales Working capital. Working Capital Turnover Ratio Formula Sales Working Capital You are free to use this image on your website templates etc Please provide us with an attribution link How to Provide Attribution.

OWC Current assets - non-operating current assets. To arrive at the average working capital you can sum. Working Capital at beginning of period.

100000 cash 200000 due from customers 50000 inventory 350000 current assets. ABC Company has 12000000 of net sales over the past twelve months and average working capital during that period of 2000000. Working capital can be calculated by subtracting the current assets from the current liabilities like so.

So the Net Working Capital of Jack and Co is 80000. Working Capital is calculated by. Cash Accounts Receivable.

60 Working capital turnover ratio. Net Working Capital Current Assets less cash Current Liabilities less debt or. The calculation of its working capital turnover ratio is.

The Working Capital Turnover Ratio is calculated by dividing the companys net annual sales by its average working capital. Net Working Capital Current Assets Current Liabilities. 12000000 Net sales 2000000 Average working capital.

Working Capital Current Assets Current Liabilities The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off. Example of the Working Capital Turnover Ratio. Article Link to be Hyperlinked.

Working Capital iscalculated using the formula given below Working Capital Current Assets Current Liabilities 1. Net Operating Working Capital Cash Accounts Receivable Inventories Accounts Payable. Working Capital Current Assets - Current Liabilities.

Net Sales Working Capital. In this formula the working capital is calculated by subtracting a companys current liabilities from its current assets. The working capital formula is.

As a result the working capital turnover ratio will be 5. Total Net Operating Capital Net Operating Working Capital Non-current Operating Assets. And formula for quick ratio is.

The net operating profit before tax is Rs. This indicates that XYZ Ltd can pay all their current liabilities using only current assets. Calculate the Working Capital Turnover Ratio with the below information and Interpret the same.

240000 140000 280000 1000002. Working capital turnover ratio is 100000002000000 5. Net Working Capital NWC Formula.

Working Capital Turnover Net Annual Sales Average Working Capital beginaligned textWorking Capital TurnoverfractextNet Annual Sales. Fixed Assets Turnover Ratio. The reason is that cash and debt are both non-operational and do not directly generate revenue.

Net Working Capital NWC Operating Current Assets Operating Current Liabilities. For example if a company 10 million in sales for a calendar year 2 million in working capital its working capital turnover ratio would be 5 million 10 million net annual sales divided by 2. The Formula for Working Capital Turnover Is.

WC Turnover Ratio Revenue Average Working Capital. Since XYZ ltd current assets exceeded the current liabilities the working capital of XYZ Ltd is positive. The formula for calculating net working capital is.

In other words the company is highly liquid and financially sound in the short term. The net operating working capital formula is calculated by subtracting working liabilities from working assets like this. NWC total assets - total liabilities.

Since the turnover ratio is high it shows that the companys management is effective in utilizing the companys short-term liabilities and assets to support sales. Capital turnover is the measure that indicates organizations efficiency in relation to the utilization of capital employed in the business and it is calculated as a ratio of total annual turnover divided by the total amount of stockholders equity also known as net worth and the higher the ratio the better is the utilization of capital employed. In this case the working capital turnover ratio will be 10000000 6000000 2000000 2.

Total net operating capital is an important input in calculation of free cash flow. Net Working Capital 28000. Effects of Low Working Capital Turnover.

Working Capital Rs 7. Net Working Capital Formula. 300000140000 214 Average working capital.

The working capital turnover ratio. A company that has a negative net working capital may need to raise capital to continue. Holding cash isnt directly related to operations.

225000 due to vendors 50000. This shows the current liquidity of a company for the coming quarter. Net Operating Working Capital Current Operating Assets Current Operating Liabilities In many cases the following formula can be used to calculate NOWC.

Working Capital at the end of the period. Cash and short-term debt are excluded from this calculation. Working Capital Turnover Ratio.

Net Working Capital Formula Current Assets Current Liabilities. Compute working capital turnover ratio of Exide from the above information. The formula to measure the working capital turnover ratio is as follows.

There are a few different methods for calculating net working capital depending on what an analyst wants to include or exclude from the value.

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Double Entry Bookkeeping

Days Working Capital Formula Calculate Example Investor S Analysis

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Different Examples With Advantages

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

Change In Net Working Capital Nwc Formula And Calculator

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Example Formula

What Is Working Capital Turnover Ratio Accounting Capital

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Turnover Ratio Formula Calculator Excel Template

How To Calculate Working Capital Turnover Ratio Flow Capital